How To Handle A Downturn and Unlock Opportunities Out of It?

29 Aug

Financial crisis, adverse supply shock, technological disruption, or natural hazards and disasters significantly affect global businesses. Recessions caused by these global incidents and problems have serious outcomes on commodity prices, stock markets, economies, and even countries.

A Downturn can be described as a contracted business cycle with a significant decline in economic activity across markets with subsequent drop in spending, GDP, real income, employment, and manufacturing. Downturns cause inflation, decline in sales revenues and profits, and cutbacks on R&D and other crucial expenditures. The scenario challenges businesses because of tightening credit conditions, slower demand, layoffs, and general insecurity.

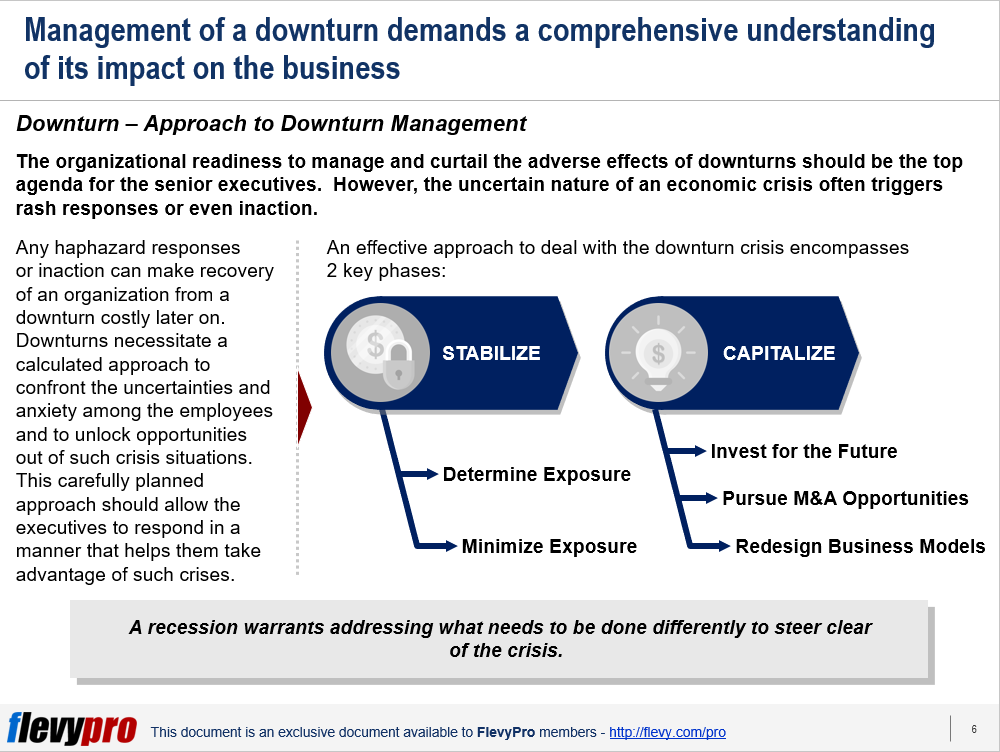

The organizational readiness to manage and curtail the adverse effects of downturns is the top agenda for the senior executives. However, the uncertain nature of an economic crisis often triggers rash responses or even inaction.

Any haphazard responses or inaction can make recovery of an organization from a downturn costly later on. Downturn management necessitate a calculated approach to confront the uncertainties, anxiety among the employees, and to unlock opportunities out of such crisis. An effective approach to deal with the downturn crisis encompasses 2 key phases:

- Stabilize

- Determine Exposure

- Minimize Exposure

- Capitalize

- Invest for the Future

- Pursue M&A Opportunities

- Redesign Business Models

Let’s dive deeper into the 2 phases.

Stabilize

This phase entails a series of actions to safeguard the organization from downturns and maintain the liquidity required to sustain the period of uncertainty. Leading organizations take downturns as an opportunity to deploy planned yet urgent, high-priority interventions to maintain standard functioning of the enterprise. They carry out careful analysis to appraise and curtail the risks of exposure. Key steps required to stabilize the organization during a downturn include:

- Determine Exposure

- Minimize Exposure

Determine Exposure

This step demands a methodical assessment of risks associated with exposure. This necessitates evaluating various scenarios and their impact on the organization as well as on the industry. The step helps in ascertaining the units that are more susceptible to downturn risks and warrants prompt action. The analysis of various scenario assists in highlighting and communicating the rationale—for interventions required to manage the downturn—to the people across the organization.

Specifically, the step involves initiating 3 fundamental actions:

- Conduct Scenario Analysis

- Quantify Impact

- Analyze Competition

Minimize Exposure

Once the executives have determined the impact of downturn exposure on their business, it’s time to work on reducing the exposure from crisis risks. An understanding of the effects of a downturn exposure on the business helps the senior executives discern the most appropriate method to subsist and make the most of their organizational performance during the downturn.

In order to subsist and minimize downturn exposure risks senior leadership needs to maintain enough liquidity and access to capital to make sound investments in future, keeping a check on cash flows by generating weekly / monthly cash reports, cutting down or delaying discretionary spending, carrying out interventions to improve fundamental business, improve business processes, and maintain the organization’s market value and positive outlook for the investors.

Specifically, the executives have to work on achieving these 3 objectives:

- Protect Financials

- Protect Existing Business

- Maximize Valuation.

Capitalize

The Capitalize phase focuses on growing the business and making the most of the economic situation. Leading organizations prudently manage downturns with greater diligence and immediate, well-thought-out response. Downturns do not preclude executives from investing in critical interventions. Most investments take time to fruition and postponing crucial investments may put an organization on the back foot when economic conditions normalize.

To capitalize on these hard times, senior executives need to carefully think about and prioritize the various investment options and endeavors critical for improving productivity and revenue, consolidate the business through mergers or acquisitions, hold back spending on projects with unclear results, shelve the endeavors that do not have a key role in future success, and invest in developing their people.

Specifically, they should chart out 3 key actions to take advantage of the crises and emerge rejuvenated after these tough times:

- Invest for the Future

- Pursue M&A Opportunities

- Redesign Business Models

Interested in learning more about the phases and key actions required to manage Downturns? You can download an editable PowerPoint on Downturn Management and Transformation here on the Flevy documents marketplace.

Are you a Management Consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

No comments yet