Artificial Intelligence (AI) Strategy: 5 Top Priorities

1 Oct

Artificial Intelligence (AI) is one area considered by many executives to enable Automation and steer positive growth. A couple of years ago, most executives thought that deployment of Artificial Intelligence isn’t a big deal. However, revamping traditional systems, implementing AI, and scaling it, in reality, is not as simple as it seems.

A survey by PwC Research in 2020, which gathered responses of 1062 business leaders, validates that scaling and industrializing AI is not straightforward at all. Only 4% of the respondents asserted that they plan on implementing organization-wide AI in 2020. A year earlier, the same survey revealed 20% of the executives planning to do that. The survey shows a significant decrease in the number of senior leaders thinking of executing AI.

The reason for this dwindling interest in AI deployment is mainly because of the tough prerequisites necessary—contemplation, resources, preparedness, overhauling legacy systems, and integration of technology applications—for enterprise-wide AI implementation.

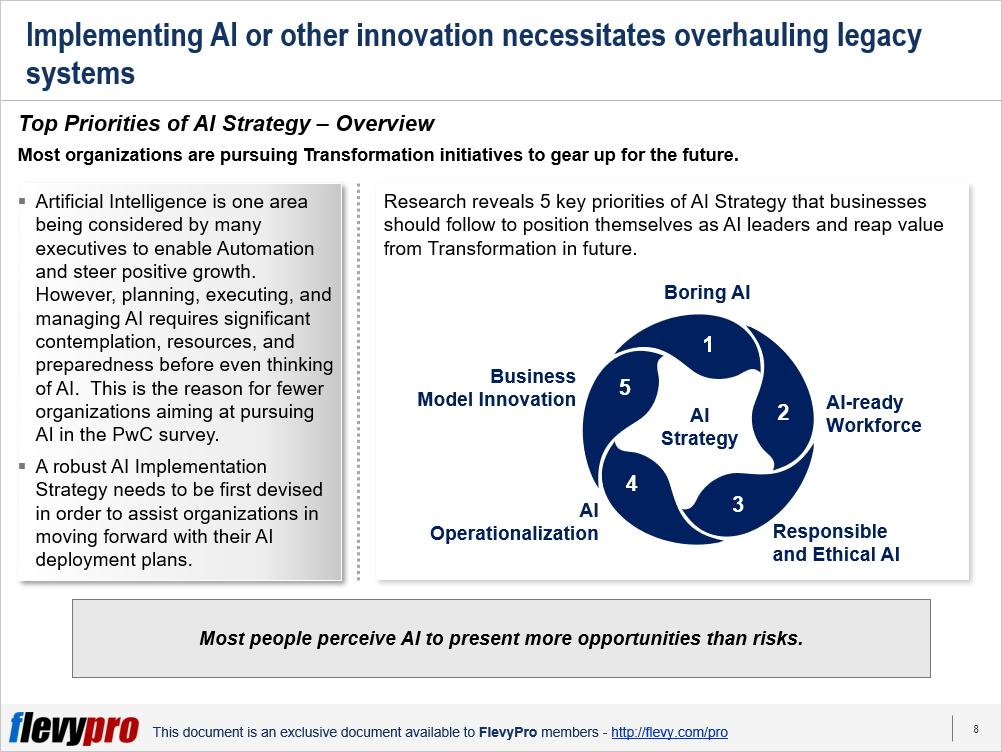

A robust AI Implementation Strategy needs to be first devised in order to assist the organizations in moving forward with their AI deployment plans. Research reveals 5 key priorities of AI Strategy that businesses should follow to position themselves as AI leaders and reap value from Transformation in future. These priorities not only highlight the key requirements for AI deployment but also pinpoint ways to maximize pay offs associated with the initiative:

- Boring AI

- AI-ready Workforce

- Responsible and Ethical AI

- AI Operationalization

- Business Model Innovation

Let’s delve deeper into a few of these key priorities.

Boring AI

One of the key reasons to employ AI, as cited by PwC research, is to automate routine administrative functions—e.g., using AI to pull information from tax forms, bills of lading, or invoices that can otherwise take up long hours of human effort. 44% of respondents revealed that AI will help them operate more efficiently.

To ensure AI adds value to the business, leaders should develop a strategy to identify the areas where AI can have a much deeper impact; build capabilities to do that; develop AI solutions, govern them, and embed them with existing systems.

AI-ready Workforce

Building or enhancing the capabilities of the workforce to become AI ready is critical today not only for technology enterprises but also for other businesses. Organizations should identify the skills required for AI and train their people to deploy AI solutions.

However, thinking of achieving this through traditional means of offering training sessions isn’t a viable strategy to tap the opportunities offered by AI. In addition to training people, organizations should cross-skill their people in multiple trades and provide them the opportunities to apply and hone in the skills learnt. In fact, organizations should reward people who apply what they learn into real-time problem-solving and productivity enhancement.

Responsible and Ethical AI

AI can be perilous if adequate understanding of its responsible use and necessary procedures to protect against its risks and negative usage are not taken. There are growing apprehensions around AI related risks e.g., biased algorithms, facial recognition tools, and deep fakes. As per PwC survey, a large majority of respondents, using AI routinely, declared readiness in their organizations in terms of taking sufficient measures to protect against AI risks.

However, in reality most organizations are quite far from implementing controls around data and decisions generated using AI. Just about 33% businesses mentioned having the ability to fully tackle risks associated with data powering AI, AI models, outputs, and reporting. It is imperative to have rigorous Risk Management processes in place to effectively use AI in the workplace and address the risks associated with it. AI risks can be mitigated by integrating processes, tools, and controls needed to address AI bias, explainability, security, accountability, and ethics.

Interested in learning more about the other key strategic priorities essential for AI deployment readiness? You can download an editable PowerPoint on Artificial Intelligence Strategy: Top Priorities here on the Flevy documents marketplace.

Do You Find Value in This Framework?

You can download in-depth presentations on this and hundreds of similar business frameworks from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives. Here’s what some have to say:

“My FlevyPro subscription provides me with the most popular frameworks and decks in demand in today’s market. They not only augment my existing consulting and coaching offerings and delivery, but also keep me abreast of the latest trends, inspire new products and service offerings for my practice, and educate me in a fraction of the time and money of other solutions. I strongly recommend FlevyPro to any consultant serious about success.”

– Bill Branson, Founder at Strategic Business Architects

“As a niche strategic consulting firm, Flevy and FlevyPro frameworks and documents are an on-going reference to help us structure our findings and recommendations to our clients as well as improve their clarity, strength, and visual power. For us, it is an invaluable resource to increase our impact and value.”

– David Coloma, Consulting Area Manager at Cynertia Consulting

“FlevyPro has been a brilliant resource for me, as an independent growth consultant, to access a vast knowledge bank of presentations to support my work with clients. In terms of RoI, the value I received from the very first presentation I downloaded paid for my subscription many times over! The quality of the decks available allows me to punch way above my weight – it’s like having the resources of a Big 4 consultancy at your fingertips at a microscopic fraction of the overhead.”

– Roderick Cameron, Founding Partner at SGFE Ltd