7 Steps to Focus-Driven Growth

9 Nov

Editor’s Note: If you are interested in becoming an expert on Strategy Development, take a look at Flevy’s Strategy Development Frameworks offering here. This is a curated collection of best practice frameworks based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. By learning and applying these concepts, you can stay ahead of the curve. Full details here.

What makes companies great in their industries is sustained above-average Growth.

Conventional approach to Organic Growth has business leaders extending their existing product lines and brands, as well as entering new geographic regions. This conventional Growth Strategy at some point in time starts failing to provide the results required to hold market leadership positions.

Focus-driven Growth is an approach that provides results regardless of the economic environment. The approach demands that the leadership team keep a methodical approach that covers the entirety of the business cycle i.e., from Strategic Planning and Strategic Vision to Strategy Execution and Performance Management.

Outwardly mature businesses can be reinvigorated by making a small number of—but larger—bets and by concentrating unremittingly on implementing a straightforward but forceful vision.

This approach has been successfully tested and has proven its mettle in at least 3 well-known companies, on 3 continents, over a span of 10 years.

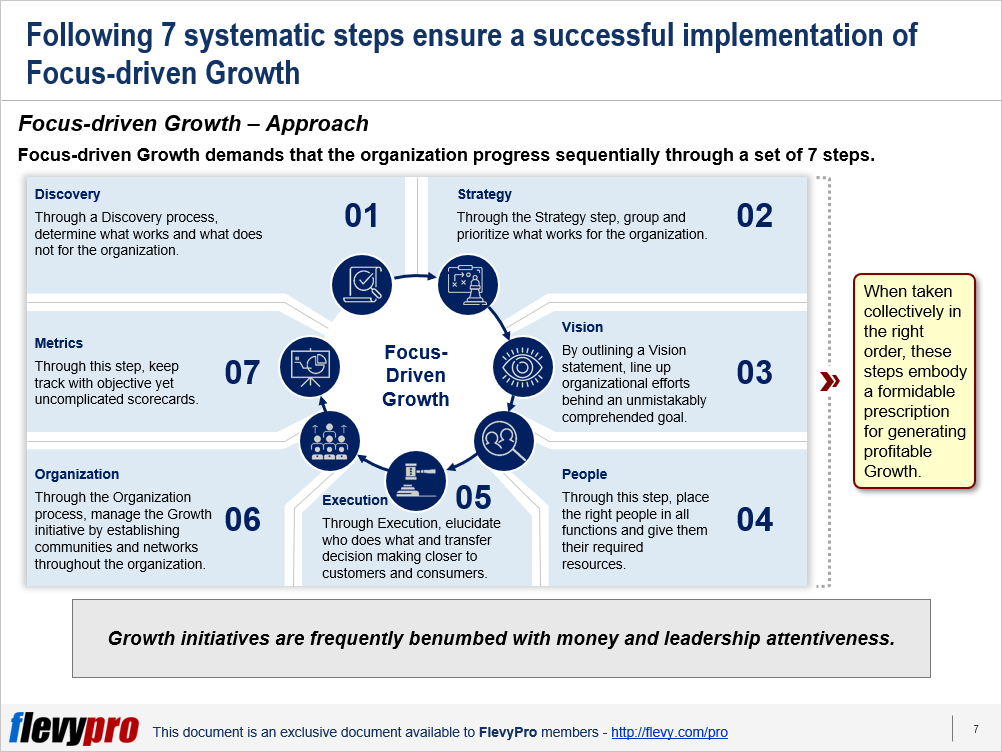

Focus-driven Growth demands that the organization progress sequentially through a set of 7 steps.

- Discovery—Through a Discovery process, determine what works and what does not for the organization.

- Strategy—Through the Strategy step, group and prioritize what works for the organization.

- Vision—By outlining a Vision statement, line up organizational efforts behind an unmistakably comprehended goal.

- People—Through this step, place the right people in all functions and give them their required resources.

- Execution—Through Execution, elucidate who does what and transfer decision making closer to customers and consumers.

- Organization—Through the Organization process, manage the Growth initiative by establishing communities and networks throughout the organization.

- Metrics—Through this step, keep a track of Growth with objective yet uncomplicated scorecards.

When taken collectively in the right order, these steps embody a formidable prescription for generating profitable Growth.

Let us delve a little deeper into some of the steps.

Discovery

Every organization has segments of Growth areas. This step entails discovering those areas for further processing. Leadership of the organization should gather in a series of workshops and identify which areas of the business are performing far better than the others. Identified segments become the focus areas of Growth because it is easier to refine and enlarge the successful areas rather than remedy what is not working.

Strategy

Focus areas discovered in the 1st step need to be grouped and prioritized in order to delineate the focused bets that the company ought to make. Focus areas may be categories, brands, geographies, platforms, that are doing well.

A single page preliminary strategy roadmap giving priority for each area results from the above process.

Vision

Outcomes of Step 2 have to be summarized into a forceful yet uncomplicated Vision which serves to align efforts behind a clearly grasped goal.

Interested in learning more about Focus-driven Growth? You can download an editable PowerPoint on Focus-driven Growth here on the Flevy documents marketplace.

Want to Achieve Excellence in Strategy Development?

Gain the knowledge and develop the expertise to become an expert in Strategy Development. Our frameworks are based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. Click here for full details.

“Strategy without Tactics is the slowest route to victory. Tactics without Strategy is the noise before defeat.” – Sun Tzu

For effective Strategy Development and Strategic Planning, we must master both Strategy and Tactics. Our frameworks cover all phases of Strategy, from Strategy Design and Formulation to Strategy Deployment and Execution; as well as all levels of Strategy, from Corporate Strategy to Business Strategy to “Tactical” Strategy. Many of these methodologies are authored by global strategy consulting firms and have been successfully implemented at their Fortune 100 client organizations.

These frameworks include Porter’s Five Forces, BCG Growth-Share Matrix, Greiner’s Growth Model, Capabilities-driven Strategy (CDS), Business Model Innovation (BMI), Value Chain Analysis (VCA), Endgame Niche Strategies, Value Patterns, Integrated Strategy Model for Value Creation, Scenario Planning, to name a few.

Learn about our Strategy Development Best Practice Frameworks here.

Do You Find Value in This Framework?

You can download in-depth presentations on this and hundreds of similar business frameworks from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives. Here’s what some have to say:

“My FlevyPro subscription provides me with the most popular frameworks and decks in demand in today’s market. They not only augment my existing consulting and coaching offerings and delivery, but also keep me abreast of the latest trends, inspire new products and service offerings for my practice, and educate me in a fraction of the time and money of other solutions. I strongly recommend FlevyPro to any consultant serious about success.”

– Bill Branson, Founder at Strategic Business Architects

“As a niche strategic consulting firm, Flevy and FlevyPro frameworks and documents are an on-going reference to help us structure our findings and recommendations to our clients as well as improve their clarity, strength, and visual power. For us, it is an invaluable resource to increase our impact and value.”

– David Coloma, Consulting Area Manager at Cynertia Consulting

“FlevyPro has been a brilliant resource for me, as an independent growth consultant, to access a vast knowledge bank of presentations to support my work with clients. In terms of RoI, the value I received from the very first presentation I downloaded paid for my subscription many times over! The quality of the decks available allows me to punch way above my weight – it’s like having the resources of a Big 4 consultancy at your fingertips at a microscopic fraction of the overhead.”

– Roderick Cameron, Founding Partner at SGFE Ltd