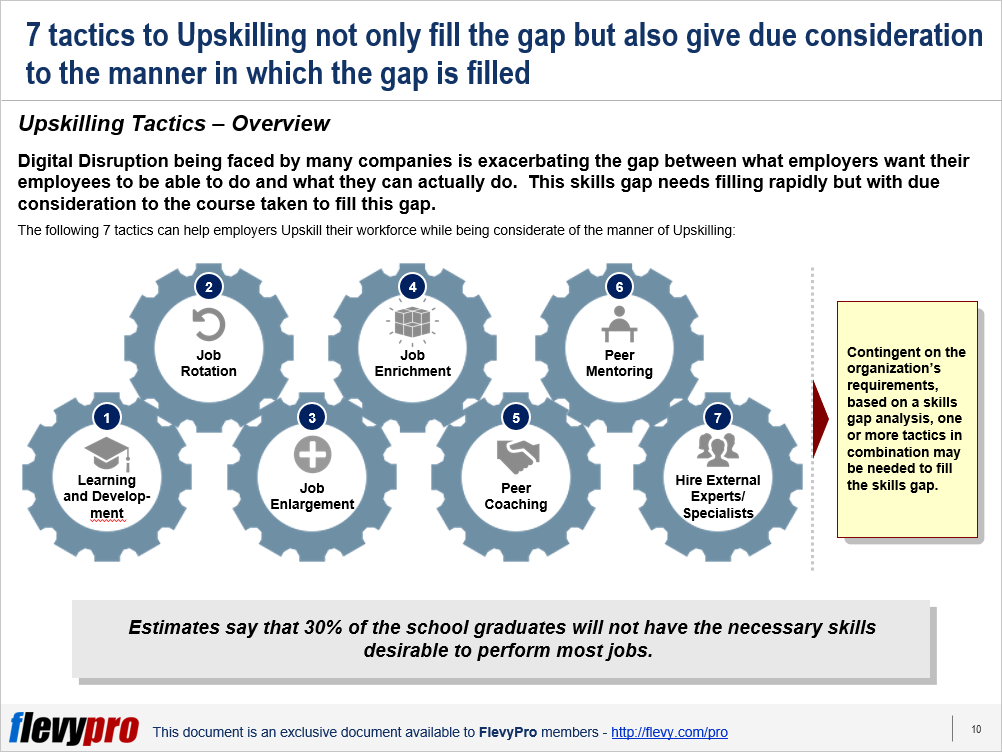

10 Hidden Strategic Opportunities

25 Dec

Potential opportunities always surround leaders. It is up to them to pounce on those or regret overlooking them, when someone else takes advantage of them.

Leaders’ personal beliefs and assumptions often clash reality. The trait is categorized as “confirmation bias” in Psychology, where individuals pick the data that supports their existing opinions and approaches and doubt information which defies their mindsets. Leadership needs to develop themselves to the level to consider the slight hints of the opportunities surrounding them.

There are 10 hidden strategic opportunities that—exist in all businesses and geographies but—are often overlooked by the leadership due to personal biases. These opportunities go unnoticed because they are often disguised in the form of anomalies and contradictions to leaders’ existing beliefs and assumptions. It’s up to the leaders to control personal bias; explore anomalies; and develop capabilities to uncover and seize these 10 Hidden Strategic Opportunities before rivals do.

In this article, we will discuss the first 3 strategic opportunities.

Opportunity 1: Assuming a product already exists, but actually it doesn’t.

Most people assume that a certain product already exists. Its only when an organization ventures into that segment—with a new value proposition—that people realize that there was a void there. Such gaps are there in almost all industries, but only visionaries are able to recognize and capitalize on them—through innovation and creative product development. A number of well-known inventions—e.g., tablet computers—were thought to have already existed, but actually didn’t.

For instance, Kate Brosnahan, accessories editor for Mademoiselle magazine, realized in the 1990s that the handbag market lacked stylish yet economical functional bags. The market at the time was replete with expensive but impractical bags from top designers and functional bags deficient in style. Kate left her job and founded Kate Spade LLC, with her partner Andy Spade. Together they began creating fabric handbags which were practical as well as trendy. Soon, their products started getting appreciation from customers, including media icons.

Opportunity 2: Customer Experience should be anything but strenuous, costly, or irritating (but most of the time it is).

Fragmented and delayed customer experience results in customer churn. Annoyance caused by poor Customer Experience presents potential strategic opportunity to win customers by fixing it. They are able to see the bigger picture and strive hard to relieve customers’ aggravation and offer exemplary Customer Experience.

For instance, creation of Netflix Inc. was the result of Reed Hastings having to pay a fine of $40 as late fee for a rented video cassette he had lost. Leading organizations, such as Netflix, offer quality offerings and provide their customers seamless, quick, and pleasing experiences.

Opportunity 3. An item is often priced low only because not many people know about it.

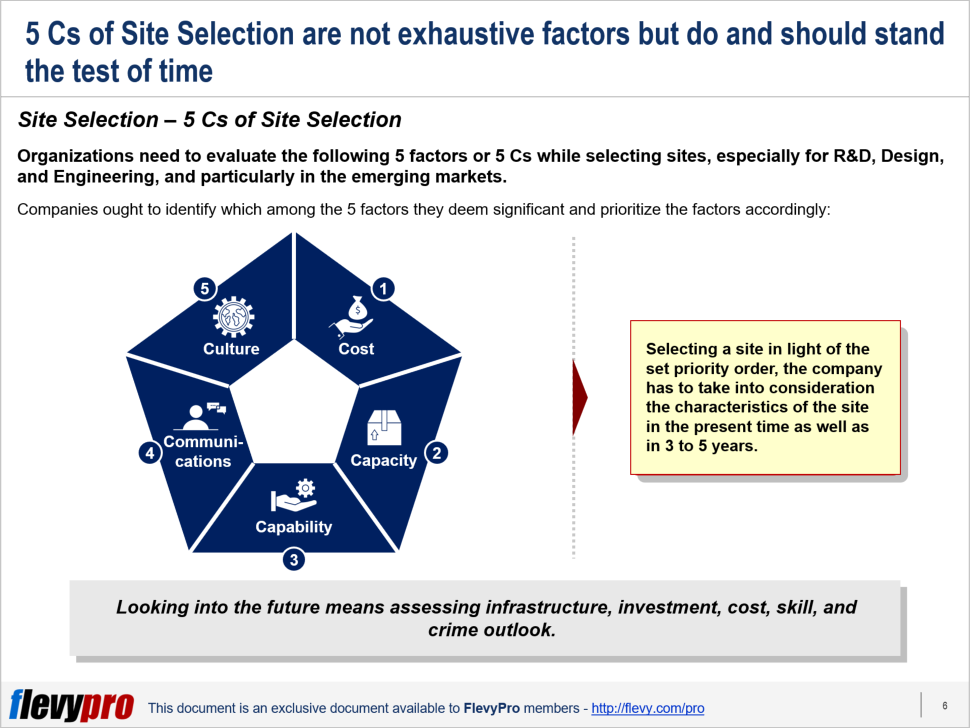

Hidden merits of a location offers an opportunity for sharp people to invest in for future appreciation. One of the reasons for inexpensive resources or items is the lack of their awareness and cognizance of their true potential among people. When people recognize the potential of a property or resource, its price rises steeply.

Interested in learning more about the other hidden strategic opportunities? You can download an editable PowerPoint on 10 Hidden Strategic Opportunities here on the Flevy documents marketplace.

Do You Find Value in This Framework?

You can download in-depth presentations on this and hundreds of similar business frameworks from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives. Here’s what some have to say:

“My FlevyPro subscription provides me with the most popular frameworks and decks in demand in today’s market. They not only augment my existing consulting and coaching offerings and delivery, but also keep me abreast of the latest trends, inspire new products and service offerings for my practice, and educate me in a fraction of the time and money of other solutions. I strongly recommend FlevyPro to any consultant serious about success.”

– Bill Branson, Founder at Strategic Business Architects

“As a niche strategic consulting firm, Flevy and FlevyPro frameworks and documents are an on-going reference to help us structure our findings and recommendations to our clients as well as improve their clarity, strength, and visual power. For us, it is an invaluable resource to increase our impact and value.”

– David Coloma, Consulting Area Manager at Cynertia Consulting

“FlevyPro has been a brilliant resource for me, as an independent growth consultant, to access a vast knowledge bank of presentations to support my work with clients. In terms of RoI, the value I received from the very first presentation I downloaded paid for my subscription many times over! The quality of the decks available allows me to punch way above my weight – it’s like having the resources of a Big 4 consultancy at your fingertips at a microscopic fraction of the overhead.”

– Roderick Cameron, Founding Partner at SGFE Ltd