Utilizing Van Westendorp Price Sensitivity Meter (PSM) to Appreciate Consumers’ Willingness to Pay (WTP) for a Product

9 Jul

The decision for pricing a product or service isn’t as simple as it seems. It is a key consideration for executives. Pricing way above the rival products risks not attracting the required customers while charging way below the competitor products could be equally detrimental.

Manufacturers can utilize research to have a better understanding on what consumers are willing to pay for a product. There are a host of research-based pricing approaches available — e.g., Monadic, Sequential Monadic, Conjoint Analysis, Van Westendorp Price Sensitivity Meter etc. — however, researchers often get confused on which one to use in a given product development phase. Let’s discuss the Van Westendorp Price Sensitivity Meter approach for now.

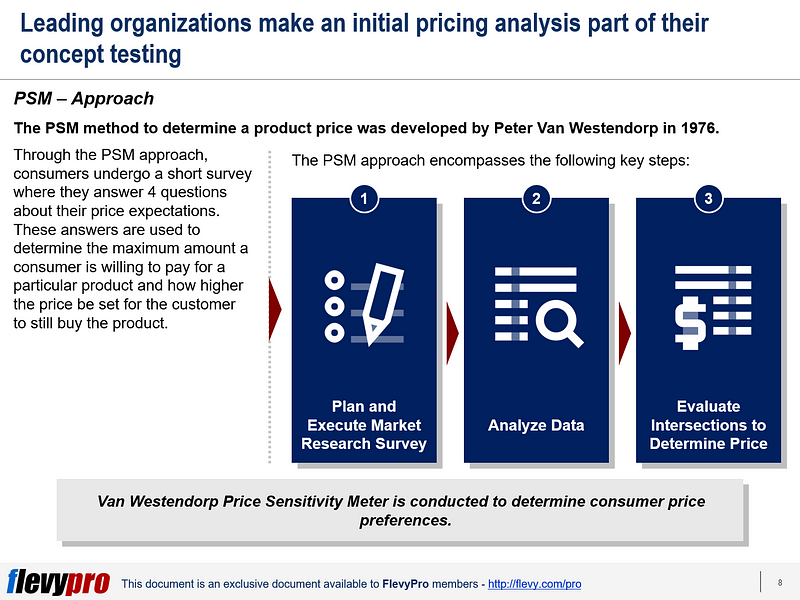

The Price Sensitivity Meter (PSM) is an easy-to-use method of evaluating price of a new product. The method was developed by Peter Van Westendorp in 1976. Through the PSM approach, consumers undergo a short survey where they answer 4 questions about their price expectations. These answers are used to determine the maximum amount a consumer is willing to pay for a particular product and how higher the price be set for the customer to still buy the product.

The approach offers a ball-park figure for the price of a product, is easy to administer, requires less effort from the consumers, and the PSM results are communicated in the form of simple diagrams. The approach, however, surveys only the “willingness to pay” attribute of a product, and is more appropriate for innovative products — as it is not easy to determine prices with competing products using this approach. PSM analysis should be a part of your Pricing Strategy process.

The PSM approach encompasses the following key phases:

- Plan and Execute Market Research Survey

- Analyze Data

- Evaluate Intersections to Determine Price

Let’s discuss the first 2 phases of the approach.

Plan and Execute Market Research Survey

The initial phase of the PSM research entails deciding on the medium of the study and planning the logistics, design, resources, guidelines, and governance protocols for the survey. More specifically, the phase involves:

- Preparing the field research plans.

- Determining whether the survey should be conducted online, telephonically, or face-to-face.

- Identifying the consumers (respondents).

- Assigning the required resources to the survey.

- Getting the data collection tools and research instrument (questionnaire) ready.

The study questionnaire should include the following questions:

- At what price the product would become so expensive for you to even consider buying it?

- Indicate the price that is expensive for you but you would still buy the product?

- What would be the price that is too cheap for the product where you would start doubting its quality and not buy it?

- Indicate the price of the product where you would consider it a great value for money (a bargain)?

- Gathering data from the survey participants.

Analyze Data

The second phase pertains to analyzing the respondents’ data from the field survey. This is done once the field data has been validated and cleansed of any inconsistent errors. The steps taken in this phase include:

- Ordering the 4 questions in a manner that it ranks prices as “Too Cheap,” “Bargain,” “Getting Expensive,” and “Too Expensive.” The values of these ranks should be kept in numeric dollar values.

- Plotting the responses of the survey participants on a graph.

- Depicting the prices on the X-axis.

- Representing the percentage of consumers who quoted the respective price (i.e. the cumulative frequency) on the Y-axis.

- Reversing the values of the two curves.

- The curves with the values “Too Cheap” and “Too Expensive” are drawn with inverse values. This creates two other curves. These curves show the percentage of consumers who regard prices as “Getting Expensive” and “Bargain.”

nterested in learning more about the other phase of the Van Westendorp Price Sensitivity Meter? You can download an editable PowerPoint on the Price Sensitivity Meter (PSM) here on the Flevy documents marketplace.

Are you a Management Consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.